Should Michigan Become a High-Tax State?

Proposed ballot measure would more than double state tax rate

The activist group Invest in MI Kids is currently collecting signatures throughout Michigan to place a measure on the 2026 Election Day ballot to raise Michigan’s top tax rate from 4.25% to 9.25%. This 118% tax hike would apply to successful Michigan families and small businesses, the vast majority of which are structured as “pass-throughs” and pay individual tax rates.

The ballot measure stipulates that tax hike revenue would fund Michigan schools. In practice, this means the tax dollars would go to a mixture of classrooms, administrators, teachers unions, retiree pensions, and school contractors such as tech companies that provide Chromebooks and online learning software districts now rely on. Around one-third of Michigan school payroll currently goes to retired teachers’ pensions.

The proposal would make Michigan’s state income tax the seventh-highest in the nation. However, when you include municipal income taxes levied by cities such as Detroit, Grand Rapids, and Lansing, the top tax rate would rise from 9.25% to around 11%, making Michigan one of the highest-tax states in the nation.

When you include Michigan’s high property taxes, the ballot measure would push the combined federal, state, and local marginal taxes successful Michiganders pay to more than 50%. Small businesses and employees often toil for decades to reach this tax bracket, only to stay there for a year or two. They generally aren’t “the rich.”

But maybe the benefits of increased school funding are worth making Michigan a high-tax state. Do Michigan schools need the funding to justify such a dramatic change in the state’s tax policy? The data indicates they do not.

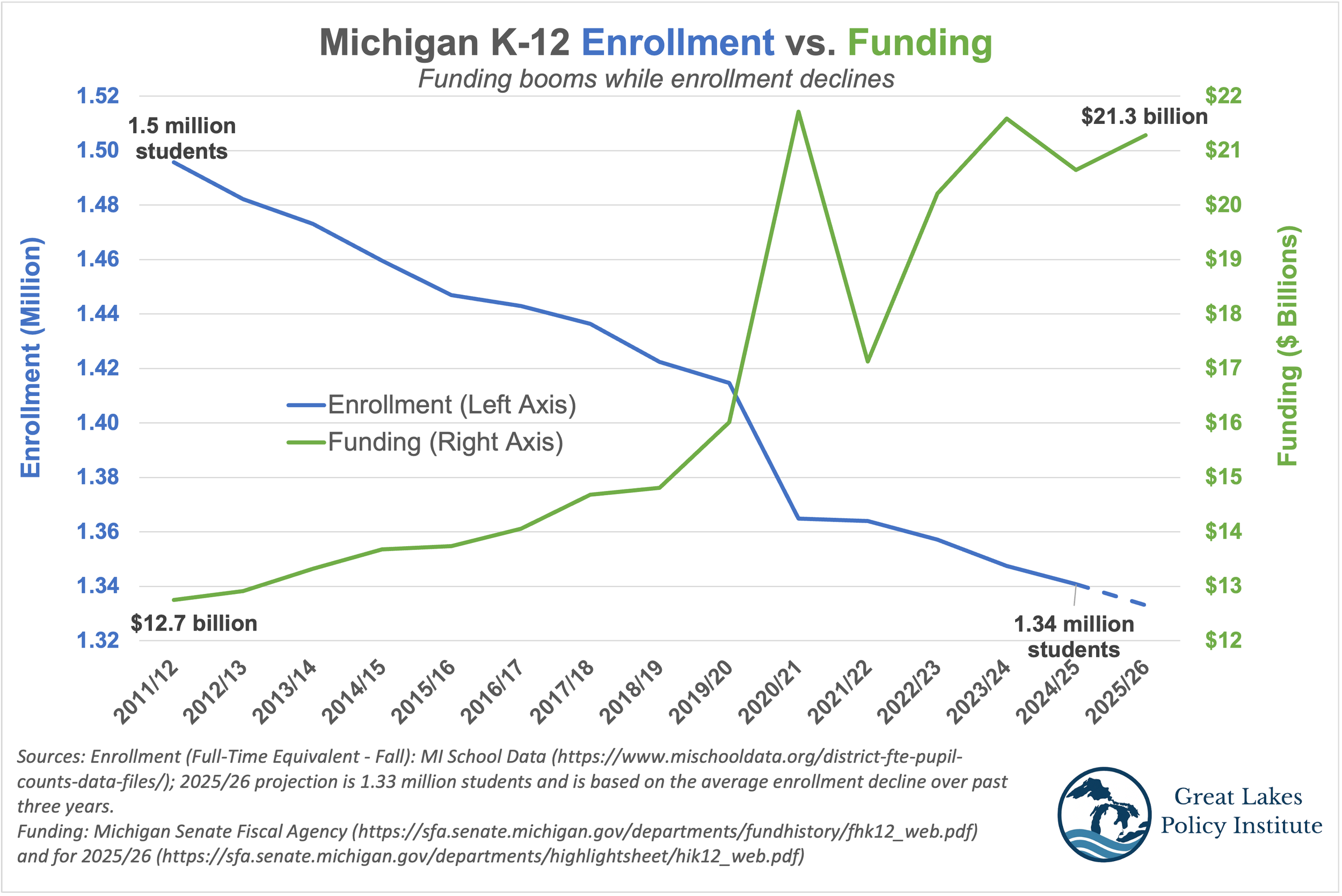

Michigan School Funding Has Boomed While Enrollment Has Plummeted

Start with the fact that Michigan schools are already well-funded and increasingly funded under the existing tax regime. According to Michigan’s Senate Fiscal Agency, total funding for K-12 schools rose from $12.7 billion to $21.3 billion between 2011/12 and 2025/26 – a 68% increase.

Has enrollment increased over this timeframe to justify this funding surge? No. In fact, the number of students has meaningfully declined. According to the state’s MI School Data, audited full-time equivalent (FTE) enrollment at Michigan K-12 schools has declined from 1.5 million students to 1.34 million between 2011/12 and 2024/25 – an 11% drop.

Declining enrollment is predicted to continue. Since 2003, no state has lost more students than Michigan.

See this indirect relationship between school funding and enrollment in the chart below:

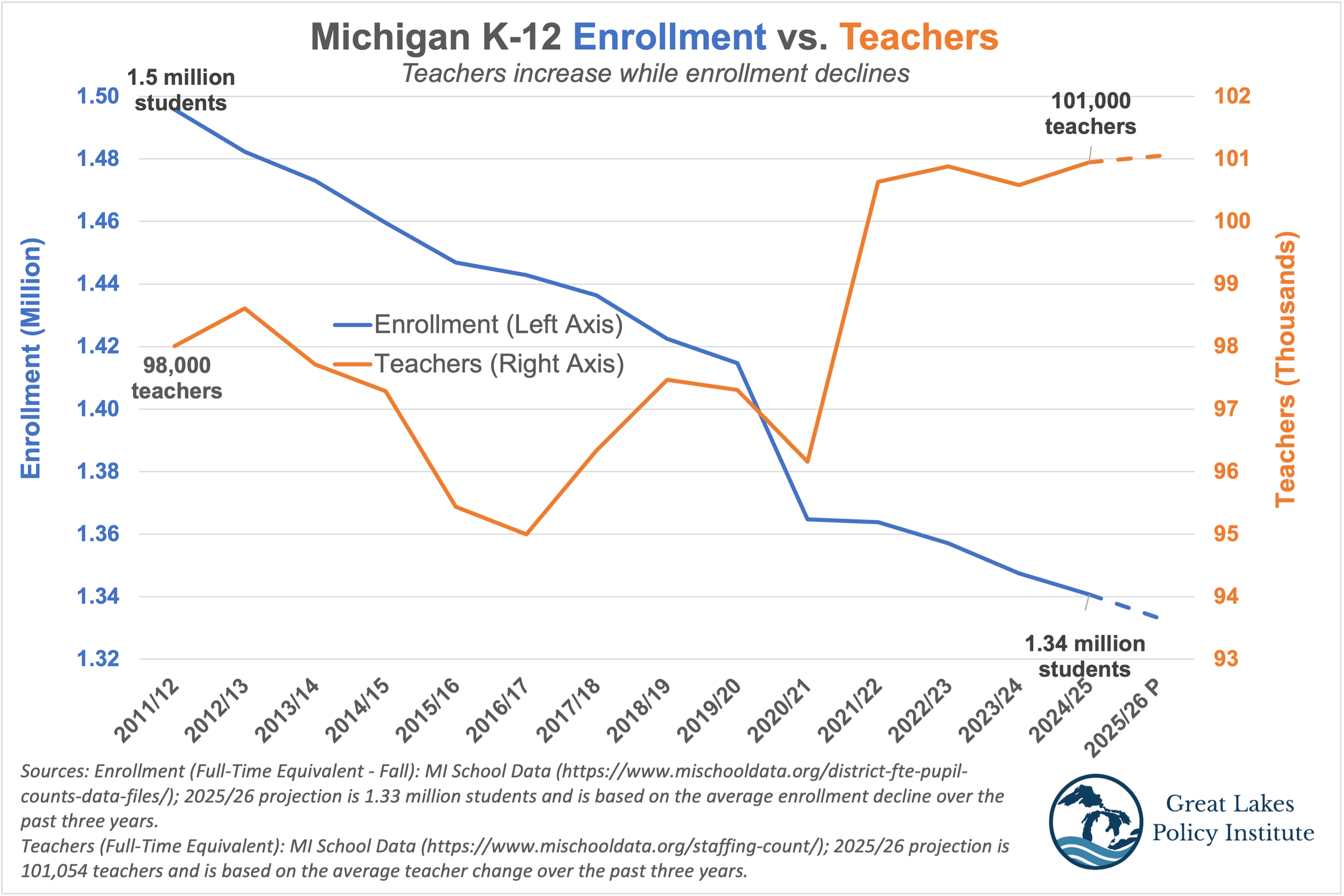

The Number of Michigan Teachers Has Increased While Students Fell

The number of K-12 teachers in Michigan has also grown, even as enrollment has declined, suggesting more money isn’t needed for staffing.* According to MI School Data, FTE teachers increased from 98,000 to 101,000 between 2011/12 and 2024/25.

See this indirect relationship between the number of teachers and students in the chart below.

*Everyone agrees Michigan’s countless hardworking, dedicated, and successful teachers deserve higher pay. But these raises can come from a mixture of existing funding increases, reducing administrative bloat, ending free lunches for students from non-poor families, lower union dues, smaller tech contracts, and revamping health plans whose skyrocketing costs cannibalize pay.

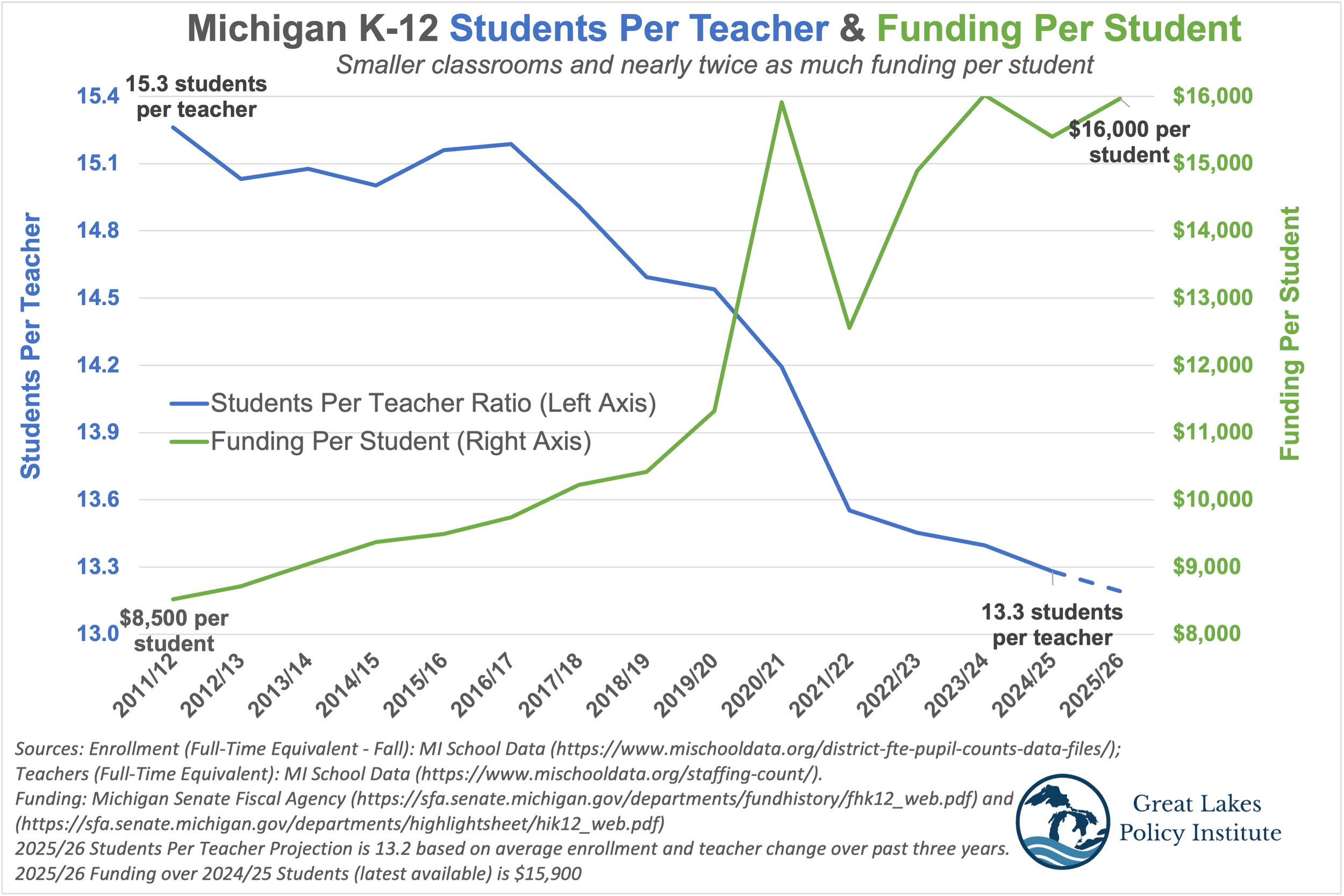

Michigan Classrooms Are Getting Smaller While Funding Per Student Has Doubled

Another way to visualize this data and determine whether Michigan schools need more funds is by looking at the following ratios: 1) students per teacher and 2) funding per student.

The number of FTE students per FTE teacher has decreased from 15.3 in 2011/12 to 13.3 in 2024/25 – a 13% drop, meaning smaller classrooms, which are trending even smaller in the years ahead.

Over the same timeframe, funding per FTE student has nearly doubled, from $8,500 to $16,000.

See these ratios showing smaller classrooms and more funding per student in the chart below.

Michigan Test Scores Plummet Even Though Funding Has Boomed

Perhaps increasing Michigan school funding would be worth it (even with declining enrollment) if it could lead to improved student performance. Many Michiganders would take the trade-off between higher taxes and smarter students.

But unfortunately, there is no correlation between increased funding and student performance. If anything, the relationship runs in the opposite direction: test results decline as funding increases.

According to the latest National Assessment of Education Progress, the share of Michigan’s eighth-grade students who are proficient in reading and math declined from 32% and 31%, respectively, to 24% between 2011 and 2024.

Michigan fourth-graders rank 44th in the country out of 50 states in reading performance, even as funding per student has nearly doubled under the tax status quo.

See this negative correlation between test scores and funding in the chart below.

There Are No Benefits to Making Michigan a High Tax State but Many Consequences

This data shows that on a variety of measures from 1) funding, 2) enrollment, 3) teachers, and 4) test scores, Michigan schools do not need more money.

While there are no benefits to making Michigan a high-tax state, there are enormous consequences for the state’s economy, including its small business job creators and successful individuals who drive a disproportionate share of spending and tax revenue.

Michigan small businesses would pay for significantly higher tax costs by reducing job opportunities, workers wages & benefits, investment & expansion, and spending on Main Street. To protect their margins, they’d also be forced to increase prices, exacerbating the cost-of-living crisis.

Or they’d leave the state altogether, as so many small businesses and successful individuals have already done. Or they’d retire and go golfing. Is it worth grinding every day when the government takes one out of every two dollars you make?

Michigan’s economy cannot afford these labor market consequences. The Great Lakes State already has the nation’s third-highest unemployment rate.

Its U6 unemployment rate, a broader labor-market measure that includes those marginally attached to the labor force, is on the verge of double digits. That’s significantly higher than competing states such as Ohio, Indiana, and even Illinois.

The lack of economic opportunity caused by more than doubling Michigan’s tax rate would exacerbate the state’s outmigration crisis. According to the Census Bureau, a net 68,000 Michiganders have left the state between mid-2020 and mid-2024 – one of the largest outflows of any state in the nation. (See tables below.)

These former residents have taken billions of dollars of economic opportunity with them. Main Streets need more customers, not fewer. Ordinary folks need more businesses they can work at, not fewer. Less economic activity is the last thing Michigan needs.

Ironically, these economic consequences may create less tax revenue for the state, the opposite of what ballot measure supporters intend. The small number of Michigan households earning $500,000 or more already pay 35% of state income taxes. Chasing even a fraction of them away to no-tax states such as Florida, Tennessee, or Texas would significantly impact state coffers.

The best way to preserve and grow tax dollars for Michigan schools and other social services is by boosting the economy. That means reducing tax burdens on small business job creators and families, allowing them to spend and invest more in their communities rather than having that money extracted to Lansing.

Don’t expropriate more money from Michigan Main Streets to the education-industrial complex.